If you’ve recently financed or leased a vehicle, you might be wondering how to add GAP insurance to your current auto policy. Good news — in most cases, it’s simple, affordable, and highly recommended. GAP (Guaranteed Asset Protection) insurance protects you financially if your car is totaled or stolen and you still owe more than it’s worth.

In this guide, we’ll walk you through exactly how to add GAP coverage to your existing auto insurance, what to expect during the process, and why it’s a smart move in 2025.

What Is GAP Insurance?

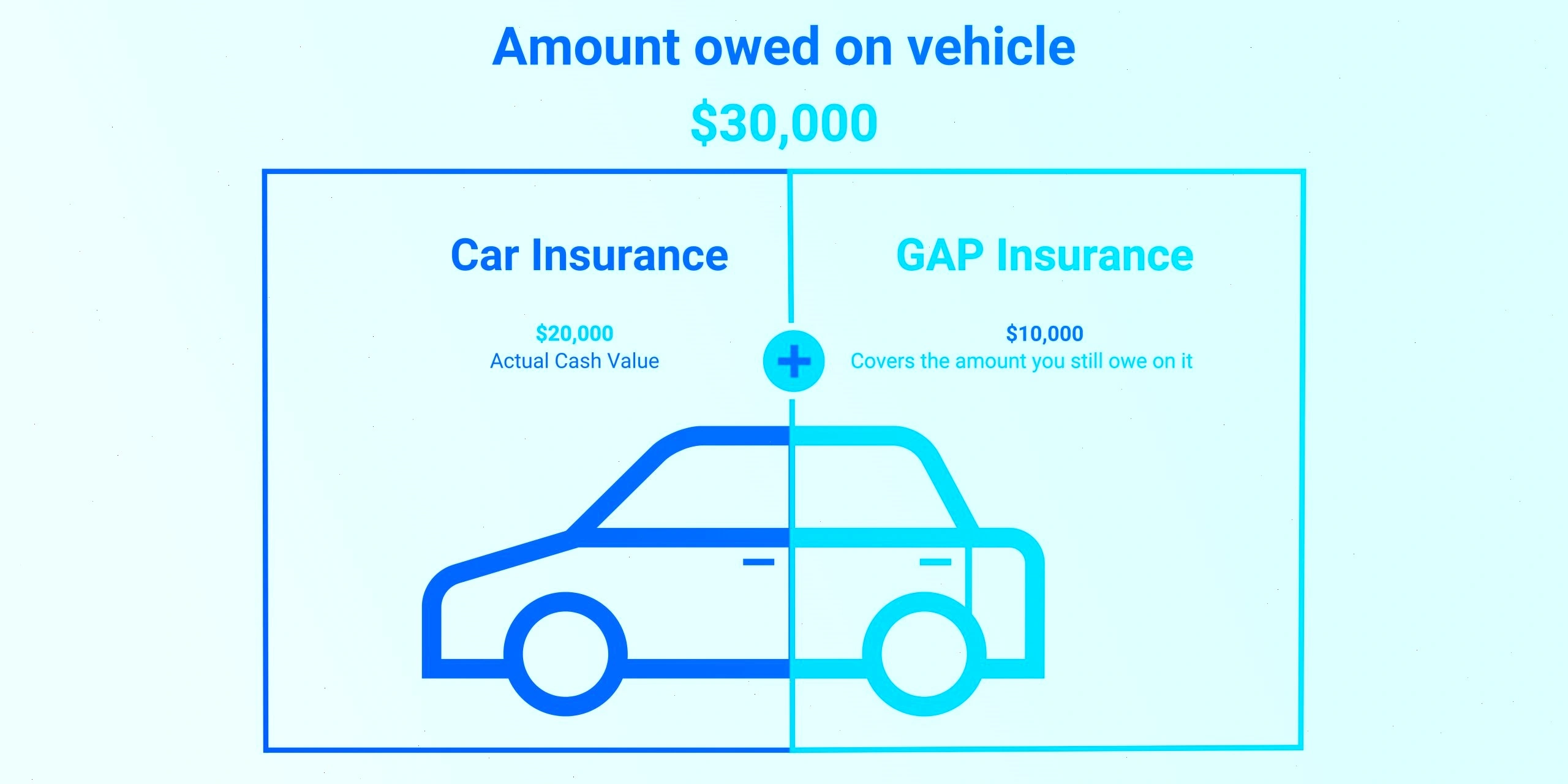

GAP insurance covers the difference between your vehicle’s actual cash value (ACV) and the remaining loan or lease balance in case of a total loss. For example, if your car’s ACV is $20,000 and you owe $25,000, GAP insurance covers the $5,000 difference.

Can You Add GAP Insurance to an Existing Policy?

Yes — many major auto insurance companies offer the option to add GAP coverage to your existing policy. Unlike buying it from a dealership (which can be expensive), adding it through your insurer is typically much more affordable and easier to manage.

Steps to Add GAP Insurance to Your Auto Policy

-

Review your current policy

Check if GAP insurance is already included. Some insurers bundle it with comprehensive and collision coverage for new vehicles.

-

Contact your insurance provider

Call or log in to your account online to inquire about adding GAP coverage. Most insurers offer it as an optional endorsement.

-

Provide necessary details

You may need to share your vehicle’s VIN, loan details, purchase price, and loan/lease term.

-

Review the cost

GAP insurance typically costs between $20 and $40 per year when added to your policy — far less than dealership options.

-

Update your policy

Once you accept the coverage and pricing, your insurer will update your policy and send a revised declaration page.

Benefits of Adding GAP Insurance Through Your Insurer

- Lower cost – Dealerships may charge $300–$700 upfront, while insurers often charge annually.

- Bundled billing – One payment and one provider for your entire auto insurance package.

- Easy cancellation – You can remove GAP coverage if it’s no longer needed.

When Should You Add GAP Insurance?

It’s best to add GAP insurance immediately after purchasing or leasing a vehicle. You’re most at risk during the first 1–3 years, when depreciation is steep and you likely owe more than the car’s value.

Final Thoughts

Adding GAP insurance to your auto policy is fast, easy, and often much cheaper than buying it at the dealership. If you’ve financed or leased a car in 2025, don’t wait — a few extra dollars a month could save you thousands in the event of a total loss.

Talk to your insurer today and enjoy peace of mind every time you hit the road.