GAP insurance offers powerful protection — especially in the early stages of an auto loan or lease. But what happens when you no longer need it? Can you cancel GAP insurance early, and if so, should you?

The answer is yes, you can usually cancel GAP insurance before your loan or lease ends. However, it’s important to understand the timing, refund policies, and potential risks involved. In this guide, we explore the pros and cons of early GAP insurance cancellation, and when it makes the most financial sense.

What Is GAP Insurance?

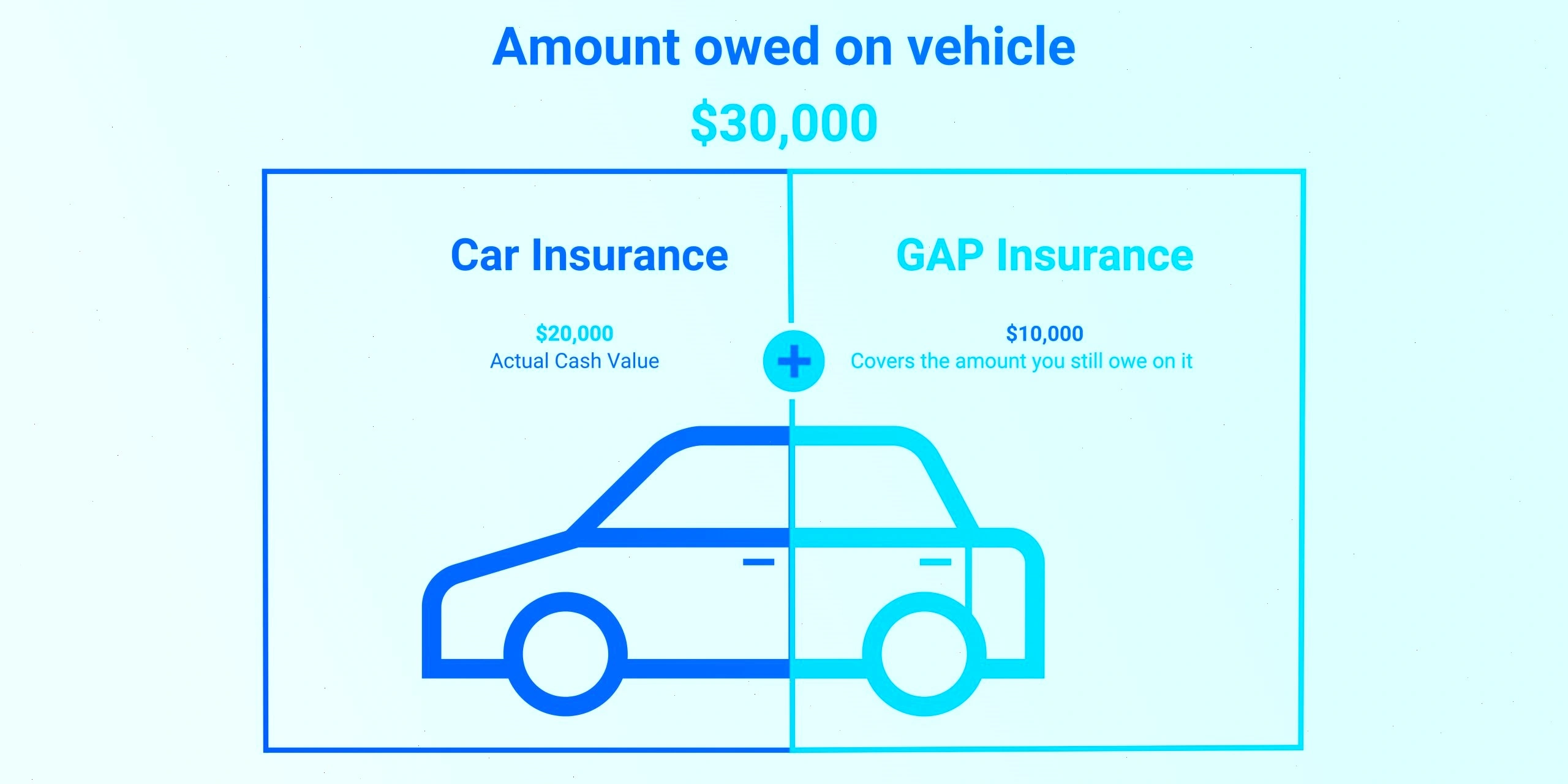

GAP (Guaranteed Asset Protection) insurance covers the difference between your car’s actual cash value (ACV) and the remaining loan or lease balance if the vehicle is stolen or totaled. It’s especially useful early in the loan term, when your car depreciates faster than you pay off the loan.

Can You Cancel GAP Insurance Early?

Yes, most providers allow you to cancel GAP insurance early — whether it was purchased from a dealership, lender, or insurance company. You’ll typically need to submit a formal cancellation request and provide documentation that your loan balance is now lower than the car’s value or that the loan is paid off.

Reasons to Cancel GAP Insurance Early

1. You’ve Paid Off the Loan

If you’ve paid off your loan ahead of schedule, GAP insurance becomes unnecessary. At this point, you no longer need coverage for the “gap” between your car’s value and the loan amount.

2. You’re No Longer Upside-Down

Once your car’s market value exceeds what you owe on the loan, the risk GAP insurance covers is gone. This is often the case halfway through a traditional loan term.

3. You’re Selling or Trading In the Vehicle

If you’re planning to trade in or sell the car, there’s no need to continue paying for GAP coverage you won’t use.

4. You Want to Switch Insurers

Some drivers cancel dealer-purchased GAP policies to switch to cheaper alternatives through their regular insurance company.

Pros of Canceling GAP Insurance Early

- Save money — You’ll stop paying for unnecessary coverage.

- Refund potential — You may qualify for a prorated refund if you paid upfront.

- Flexibility — You can explore better coverage options or use the refund toward your next vehicle.

Cons of Canceling GAP Insurance Early

- Risk of premature cancellation — Canceling too soon can leave you exposed if your car is totaled while you still owe more than it’s worth.

- Refund may be limited — Not all providers offer full or prorated refunds, especially after a certain period.

- Cancellation process — It might require paperwork, loan payoff documentation, and patience.

How to Cancel GAP Insurance

- Contact the GAP insurance provider or dealership.

- Request the cancellation form or follow their online process.

- Provide supporting documents (e.g., loan payoff letter or current balance).

- Ask about refund eligibility and timeline.

Final Thoughts

Canceling GAP insurance early can be a smart financial move — if timed correctly. If you’re no longer upside-down on your loan or have paid it off, keeping the policy may not make sense. Just be sure the timing aligns with your car’s value and loan status. A little due diligence now can save you money without sacrificing peace of mind.