How much does GAP insurance cost? This guide provides a comprehensive state-by-state breakdown of GAP insurance pricing in the United States, helping you understand what to expect and how to budget for it.

What Is GAP Insurance?

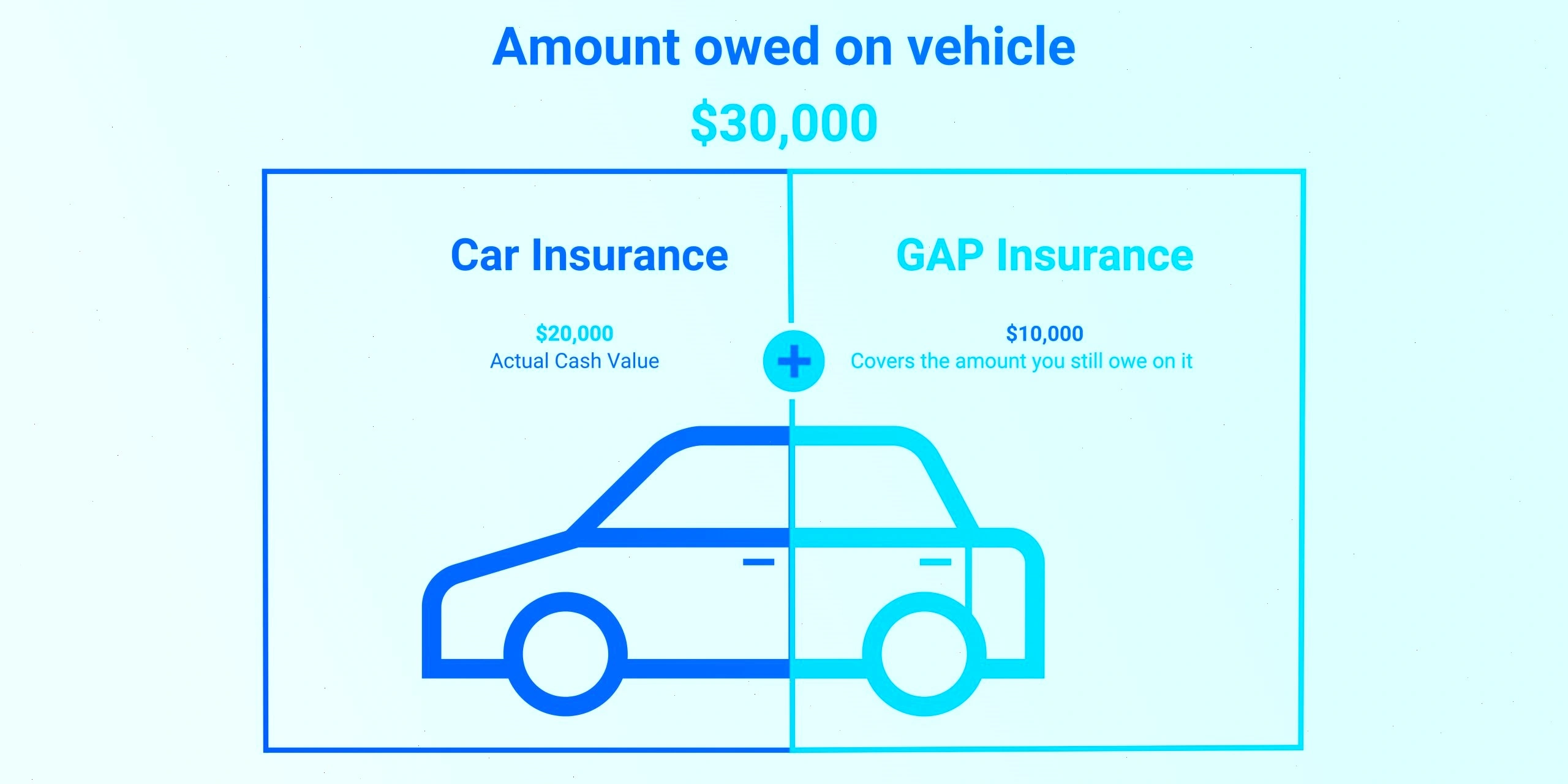

GAP insurance—short for Guaranteed Asset Protection—is an optional car insurance coverage that covers the “gap” between what your car is worth and what you owe on your auto loan if your vehicle is totaled or stolen. Standard auto insurance typically pays only the actual cash value (ACV) of your car, which may be lower than the remaining loan balance. GAP insurance ensures you’re not left paying off a loan for a car you no longer have.

Why It’s Relevant in the United States

In the U.S., many car buyers finance their vehicles with minimal down payments, which often leads to a situation where they owe more than the car’s depreciated value. This is particularly true for new cars, which can lose up to 20% of their value in the first year. GAP insurance has become a practical financial safeguard for American drivers, especially those leasing a vehicle or signing long-term auto loans.

How to Calculate GAP Insurance Cost — Step by Step

- Determine your loan amount: Know your remaining loan or lease balance.

- Find your car’s actual cash value (ACV): Use Kelley Blue Book, Edmunds, or your insurer’s valuation.

- Calculate the gap: Subtract your ACV from the loan balance. This is the amount GAP insurance would cover.

- Get quotes: Ask your dealer, lender, and car insurer for GAP insurance quotes.

- Compare annual and monthly costs: GAP insurance may be a one-time payment or added to your monthly premium.

- Check eligibility: GAP insurance may only be available for newer vehicles or loans under 5 years old.

Average GAP Insurance Cost by State

The cost of GAP insurance varies significantly by state and provider. Here’s a general snapshot of average annual prices:

- California: $400–$700 (dealer) or $20–$40/year (insurer add-on)

- Texas: $350–$600 or $25–$50/year

- Florida: $300–$550 or $20–$35/year

- New York: $400–$800 or $30–$60/year

- Illinois: $300–$500 or $20–$35/year

- Pennsylvania: $320–$540 or $25–$40/year

- Georgia: $350–$600 or $25–$45/year

- Ohio: $280–$470 or $20–$30/year

- Arizona: $300–$500 or $20–$35/year

- Washington: $310–$520 or $25–$40/year

Note: Dealership GAP insurance typically costs more and may be rolled into your financing, while insurance companies often offer cheaper add-ons to your existing policy.

Important Things to Know

GAP insurance is not required by law but is often required by lenders for high-risk loans or leases. It is only valid if you have collision and comprehensive coverage. Additionally, most insurers stop offering GAP insurance once your loan balance becomes lower than your car’s ACV. Be sure to cancel the coverage when it’s no longer needed to avoid unnecessary payments.

FAQs

- Is GAP insurance worth it?

Yes, if you owe more than your car’s current value or made a small down payment. - Can I buy GAP insurance after purchasing the car?

Yes, but only within a specific time frame, usually 30 to 60 days from purchase. - Does GAP insurance cover theft?

Yes, GAP insurance covers the difference if your car is stolen and unrecovered. - How long does GAP insurance last?

It typically lasts until your loan balance drops below the car’s value—often 1 to 3 years. - Can I cancel GAP insurance?

Yes, you can cancel it once it’s no longer beneficial. Some providers may offer a partial refund.

Conclusion

GAP insurance offers critical protection for those financing or leasing a new vehicle, especially when the vehicle depreciates faster than the loan balance decreases. Knowing how much GAP insurance costs by state helps you make a better-informed decision and avoid financial pitfalls in the event of a total loss. Always compare quotes and assess your loan-to-value ratio before purchasing GAP coverage.