If you’ve recently purchased or leased a vehicle, you may be wondering whether GAP insurance is really worth it. The answer? Absolutely — especially in specific high-risk scenarios. GAP (Guaranteed Asset Protection) insurance can be a financial lifesaver when you owe more on your car loan than the car is worth. Below, we reveal the top 5 situations when GAP insurance can save you thousands of dollars in unexpected expenses.

1. You Bought a Car With a Low Down Payment

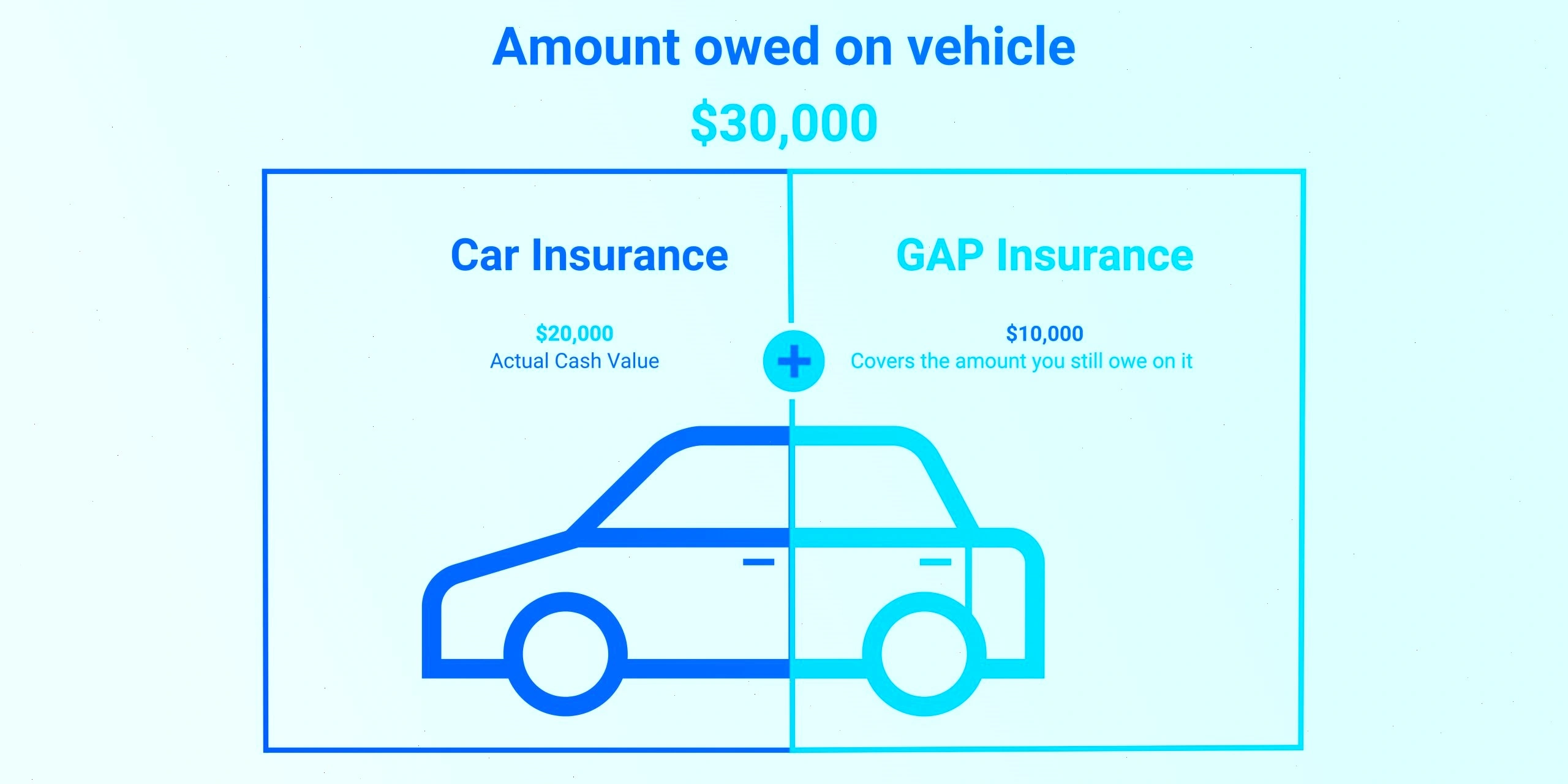

If you put down less than 20% on your car loan, there’s a high chance you’ll be “upside-down” — meaning you owe more than the vehicle’s actual cash value (ACV) — for a significant period. In the event of a total loss accident or theft, your regular insurance will only cover the ACV. GAP insurance pays the remaining loan balance, protecting you from a potentially massive out-of-pocket expense.

2. You Chose a Long-Term Auto Loan

Loans lasting 60, 72, or even 84 months are becoming more common. While they lower your monthly payments, they also increase the time it takes to build equity in your vehicle. During the first few years, your loan balance can easily exceed your car’s value. If the car is totaled early in the loan term, GAP insurance ensures you’re not stuck paying off a car you no longer have.

3. Your Car Was Totaled Shortly After Purchase

New vehicles lose up to 20% of their value in the first year alone. If your car is totaled due to an accident just months after you buy it, your insurer will only reimburse you for the depreciated value. That gap could be thousands of dollars — and without GAP insurance, you’d be responsible for covering it yourself.

4. You’re Leasing a Vehicle

Most lease agreements already require you to carry GAP insurance — and for good reason. Leased cars tend to lose value quickly, and the lease payoff amount often exceeds the ACV for most of the lease term. If your leased vehicle is stolen or totaled, GAP insurance covers the difference, so you’re not left with an unexpected lease balance.

5. You Drive a High-Depreciation Vehicle

Some cars depreciate faster than others. If you’re driving a vehicle known for steep depreciation — like certain luxury models or electric cars — you’re at higher risk of being upside-down on your loan. GAP insurance cushions the financial impact by covering the difference if disaster strikes.

Final Thoughts

GAP insurance is one of the most affordable ways to protect yourself from major financial loss. If any of the situations above apply to you, investing in GAP coverage could save you thousands. As cars become more expensive and loans stretch longer, this simple protection is more important than ever in 2025.