When protecting your car, understanding the difference between GAP insurance and full coverage is crucial — especially in 2025. While both provide financial protection, they serve very different purposes. This guide breaks down how each works and when you might need one, the other, or both.

What Is Full Coverage Auto Insurance?

Full coverage isn’t a specific policy, but rather a combination of different types of auto insurance, including:

- Liability insurance – Covers injuries or damages you cause to others.

- Collision insurance – Pays for damage to your car after an accident, regardless of fault.

- Comprehensive insurance – Covers damage from non-collision events like theft, fire, or natural disasters.

It’s designed to cover both your liability and your vehicle’s physical damage, giving you wide-ranging protection on the road.

What Is GAP Insurance?

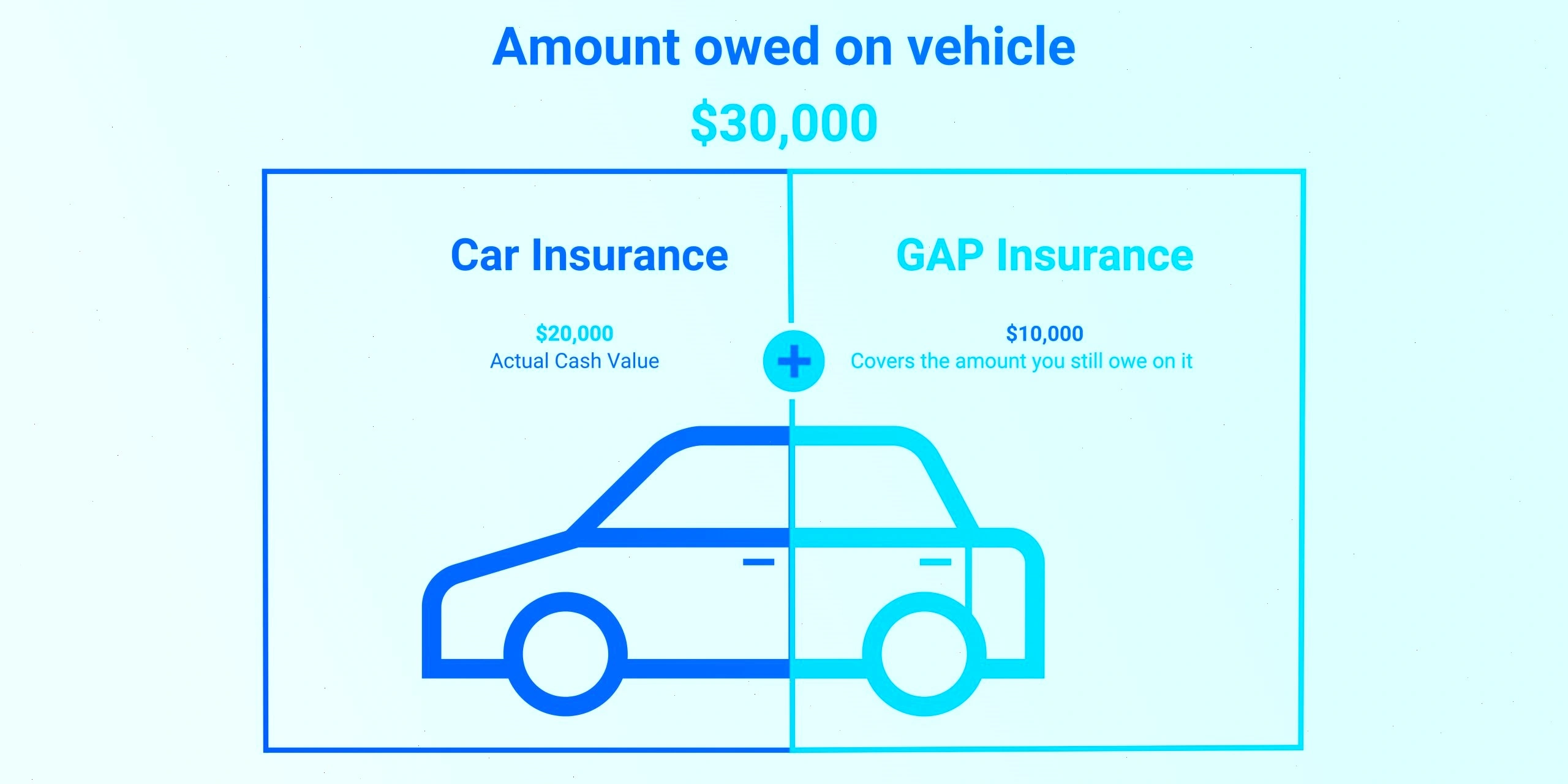

GAP (Guaranteed Asset Protection) insurance covers the difference between what your car is worth (its actual cash value) and what you still owe on your auto loan or lease if your car is totaled or stolen.

Let’s say your car is declared a total loss, and your insurer pays $20,000, but you owe $25,000 on your loan. GAP insurance covers that $5,000 gap.

Key Differences Between GAP Insurance and Full Coverage

| Feature | GAP Insurance | Full Coverage |

|---|---|---|

| Purpose | Protects against negative equity | Protects your car from accidents and other damage |

| When It Applies | When your vehicle is totaled or stolen | Any time you drive or park your car |

| Payment Recipient | Your lender | You or the other driver (depending on fault) |

| Policy Length | Until you no longer owe more than the car’s value | Ongoing, as long as you own the car |

Do You Need Both GAP Insurance and Full Coverage?

In many cases, yes. If you’re financing or leasing a new vehicle, you’re often required to have full coverage. Adding GAP insurance gives you an extra layer of protection in the early years of ownership, when your car depreciates quickly and your loan balance is still high.

Once your loan balance drops below the car’s value, GAP insurance is no longer necessary — but full coverage may still be worth keeping, especially if your vehicle is valuable.

Who Should Consider GAP Insurance?

- You made a small down payment (less than 20%)

- You chose a long-term loan (60+ months)

- You’re leasing the car

- Your vehicle depreciates rapidly

Which Is More Expensive?

Full coverage is typically more expensive, as it includes multiple types of insurance and covers more risks. GAP insurance is usually a one-time fee or a small annual premium — affordable but highly specific in what it covers.

Final Thoughts

While full coverage protects you from most driving-related risks, GAP insurance protects your finances if your car’s loan exceeds its value. If you’ve recently bought or leased a car, having both could save you thousands in the event of a total loss.

By understanding the difference, you can make smarter decisions — and drive with greater peace of mind in 2025 and beyond.